top of page

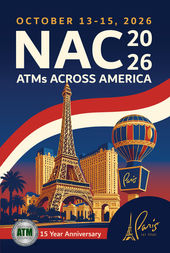

Supporting America's Independent ATM

Owners-Operators & Suppliers Since 2011

Our Mission

The National ATM Council, Inc. is a not-for-profit national trade association dedicated to ethically and effectively representing the business interests of ATM Owners, Operators and Suppliers in their efforts to provide safe, secure and convenient delivery of cash to consumers throughout the United States.

bottom of page